Five Cash Flow Issues Facing Small Business

Five of the most common cash-flow problems.

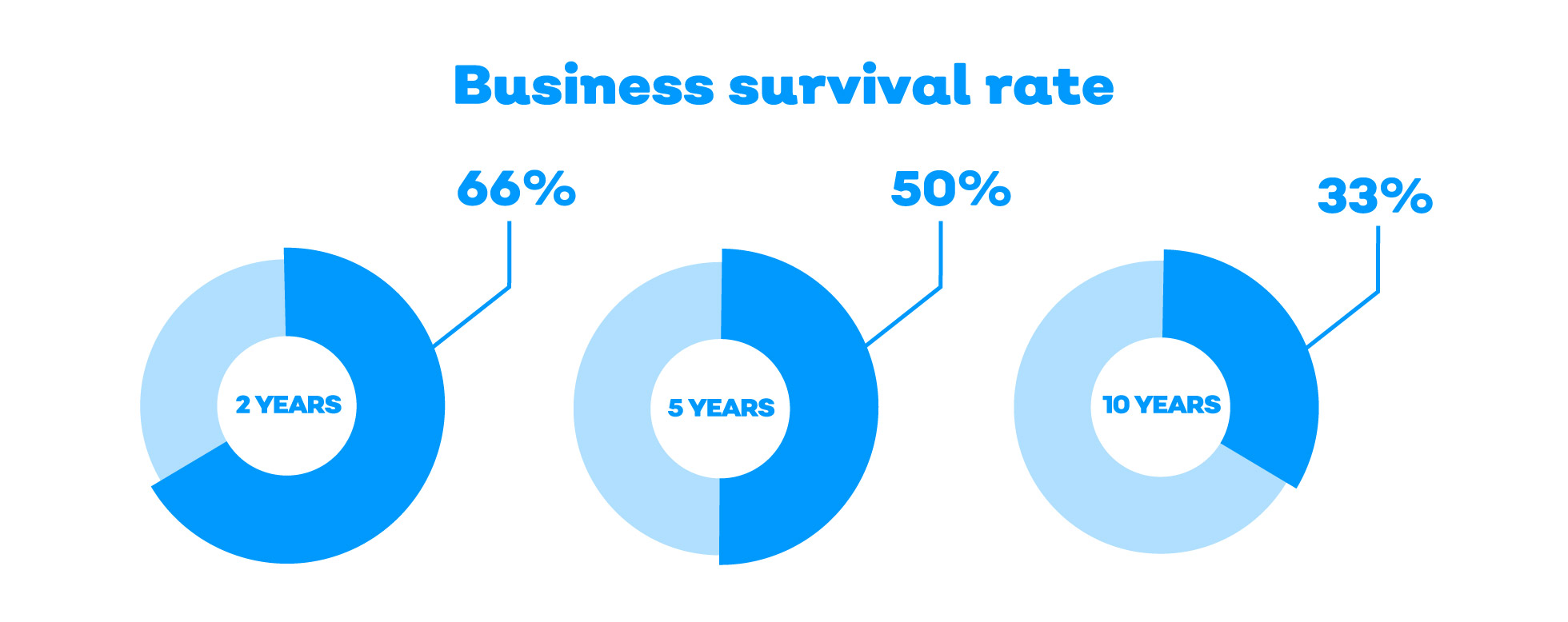

No matter how well thought out your business model is, how profitable you are or how many investors are interested in supporting your business, you won't survive if you can’t manage your company’s cash flow correctly.

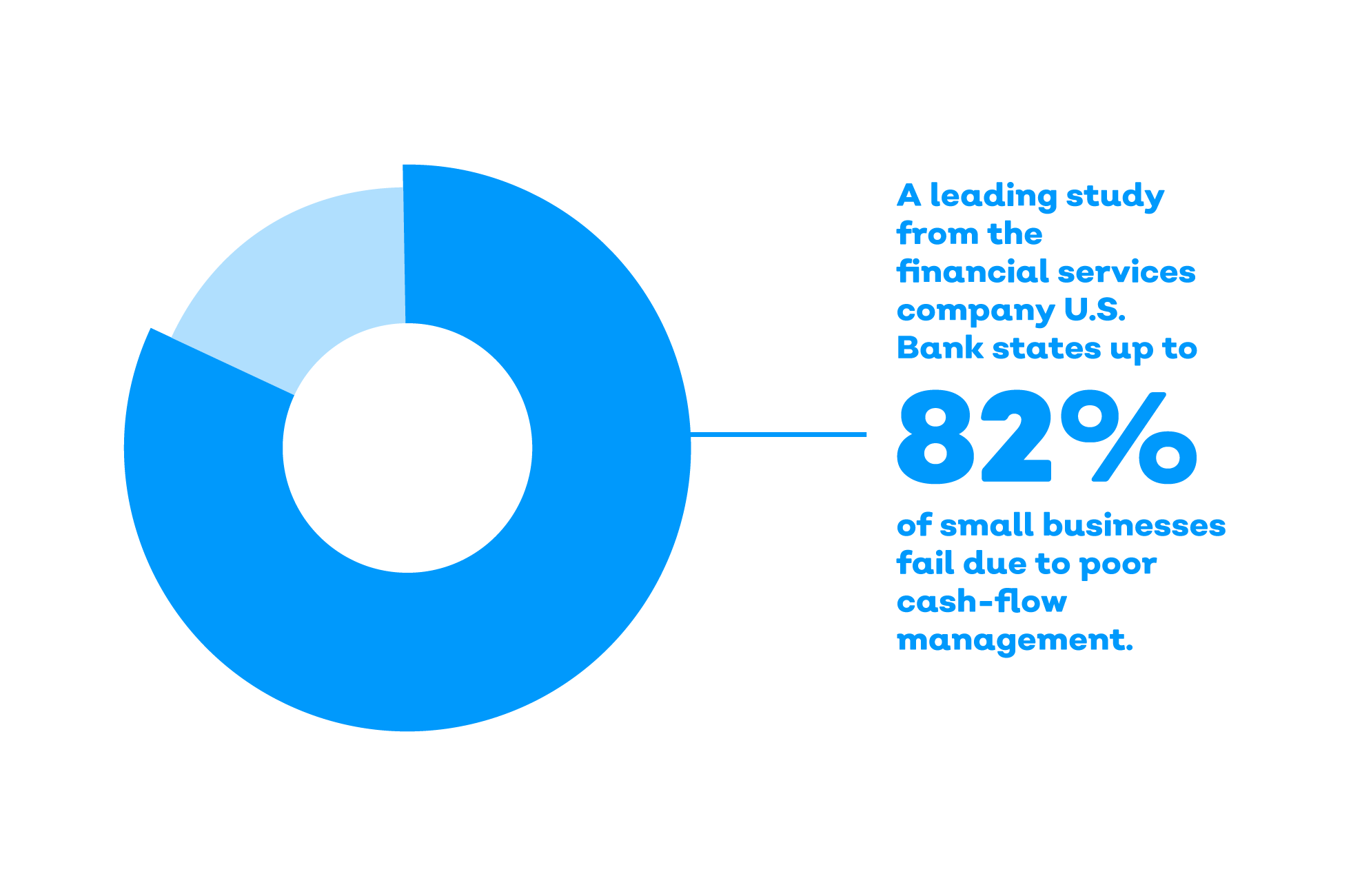

A leading study from the financial services company U.S. Bank states up to 82 per cent of small businesses fail due to poor cash-flow management. No matter how brilliant your entrepreneurial skills are, it is essential you focus on your company's cash flow. While many issues can crop up when owning a small to medium business, we've pulled together five things that we know can destabilise an industry.

Five of the most common cash-flow problems

1. The 'It takes money to make money' trap

Spending too much in the beginning phases of a business can be crippling. While impulse spending during the startup phase is a common mistake, it is sometimes an unavoidable reality of business operations. First-time business owners can often fall victim to their spending habits, especially in the first few months. The thing to remember is that not all startup expenses are created equal. Most costs are beneficial, and essential for future profits, but there are also lots of traps such as B2B services with fees that many firms don't need. Keeping your eye on the bottom line is crucial if you want your business to be as successful as it can be. It's a constant consideration of the cost-benefit ratio of every single expense. Revenue forecasting is the first step in creating a realistic budget - although the toughest part is sticking with it.

You'll need to try and calculate as best you can how long you think it will take for your business to break even. Another rule of thumb is to expect the unexpected - expenses will crop up when you least anticipate them.

While there are many opportunities for impulse spending, if you remember to go back to your projections, and ask yourself if you need that service, after all, you'll be able to curb some of your spendings. Your employees may thank you - often extra B2B services can add unnecessary steps to what were otherwise simple tasks.

2. Being passive about past-due invoices

Typically one of the biggest cash-flow killers is the deficit that is created by overdue invoices - it can completely freeze up your business cash flow. If you aren’t being proactive about collecting payments from your clients, you could be on your way to a dangerous cash-flow situation. Sadly, most small businesses won't have policies in place that help them steer clear of this pitfall. Try setting clear policies with your customers with carefully outlined penalties and consequences for when payments are late. Clients will leave you as a bottom priority for payment if you don't contact them the second payment is late. A good late payment policy includes a 5 per cent late penalty, usually after five days, and - for service-based companies - work stoppage after 30 days past due. Some businesses have even benefited from incentivising customers through discounts for early payments.

3. Overestimating expected sales volumes

It's great to be optimistic about your business (and relentless optimism is likely to be the reason you're able to overcome all the obstacles you face in your small business), but it is critical for any new business owner to be objective too. Letting it get in the way of making a sound financial call can be dangerous. Unfortunately, not every business decision will be a good one, and not every customer will make a purchase. While projected spikes during the holiday period can be expected, hoping for them to double is unrealistic. It is so vital that objective sales forecasting, based on real numbers, is complete. By using quantitative forecasting methods from past financial information as a basis for tracking trends and predicting future sales.

However, when you're in the first few years of your business you have little data to draw from; forecasting can be difficult. Working with a mentor from within a similar or the same industry will be of benefit. They can help you by using their personal experiences to predict future sales capacities. No matter which way you select, make sure to base your projected sales expectations on objective facts and sound judgment, saving you from overspending based on pipe dreams that may never come true.

4. Do you have a cash-flow budget?

So you've set expectations for future sales you feel are realistic, you've pulled in spending, AND you’re doing everything you can to make your clients pay up - now what? Another critical piece of the puzzle is to have a cash-flow budget. While the first three points will have a positive impact on your business, day-to-day cash flow may still prove to be a challenge.

In retail, if supplier payments come due before your sales happen, you may have trouble paying bills on time. In construction, some owners may have cash tied up in supplies and building materials and may have to pay contractors and subcontractors - all before a customer pays his or her bill in full. There's also the cost of materials which can increase and decrease, forcing owners to front more cash than they have. By using a cash-flow statement, business owners can track the inflow of revenue and the outflow of expenses. This can help businesses anticipate when they will have more money going out than coming in, which will help you plan for tough times ahead. Without one - it's all guesswork.

5. Moreover, finally, not having any cash saved

Even if you have every safeguard imaginable in place to protect your business cash-flow, there will always be a cash-flow problem, that's just the reality of business. While this is no huge deal if you do have a cache of savings, if a company is working from a flat or zero account balance, it can only take one slow month or one lapse in paid invoices to create havoc. To help safeguard a business from cash-flow issues, you should try and maintain your accounts to at least two months of operational expenses. This is one sure fire way to protect yourself, as even if you experience unexpected stalls in cash-flow, you'll have reserves in place.

Cash-flow issues are one of the most significant challenges of business ownership, but if you stay objective, and always look for the smartest option, you'll get through it.

However, what is your best option when cash-flow issues strike and the above measures either haven't worked or? While many people are aware of what factoring is, arguably the better option is invoice discounting. Invoice discounting is the method of using a company's unpaid accounts receivable as collateral for a loan. It is considered a very short-term form of borrowing as the lending company can adjust the amount of debt that is outstanding as soon as the new invoices come in. Invoice discounting essentially accelerates cash flow from clients. Instead of waiting and waiting for those who owe you invoices to pay within their standard credit terms, your business will receive cash almost as soon as you issue the invoice. It's a fantastic way to free up cash flow for your business. For more information, get in touch with a buffer staff member. They'll be able to help you sort out your small business cash-flow today.